blog

Exploring the Open Road: A Guide to Motorhome Road Tax Rates

Posted on: 10/11/2023

When you own a motorhome or campervan you have to pay road tax, just the same as you do when you own a car. Though some people may assume the road tax you pay for your car is a ‘catch all’ covering all of your vehicles, it is not - the leisure vehicle’s tax obligation is not covered by the car payment. In this edition of our blog we’ll dig into the subject of motorhome road tax and answer questions around it.

1. Why Do I Have to Pay Road Tax?

Motorhome road tax (also known as Vehicle Excise Duty or VED) is an important financial obligation as it contributes to the government’s coffers, out of which various road essentials are paid. Road tax can be paid as a one off fee, up front, to last six months or a year – or it can be paid month by month using direct debit. It is your choice which method you use.

2. What is Road Tax for?

Stating that road tax directly covers the cost of everything to do with UK roads you drive on is a bit simplistic. The amount you pay goes into centralised government funds available to the exchequer. However, the exchequer pays for things like highway construction, road upkeep, traffic lights, road signs and line painting.

3. What Things Influence Road Tax?

There are a few factors which influence road tax for motorhomes.

a) Size and Weight

These include the size of the vehicle’s engine plus the weight of the vehicle. In terms of vehicle weight the key figure is 3,500kg. Vehicles with a gross / maximum weight below that number are considered to be private light goods vehicles and therefore pay road tax equivalent to that.

Motorhomes with a gross / maximum weight over 3,500kg are classed as private heavy goods vehicles, and therefore pay a sum for road tax which is appropriate to that classification. The engine size of the motorhomes is also a factor which influences the amount of road tax applicable. If the engine size is 1549cc or below, road tax costs less than if the engine size is above 1549cc.

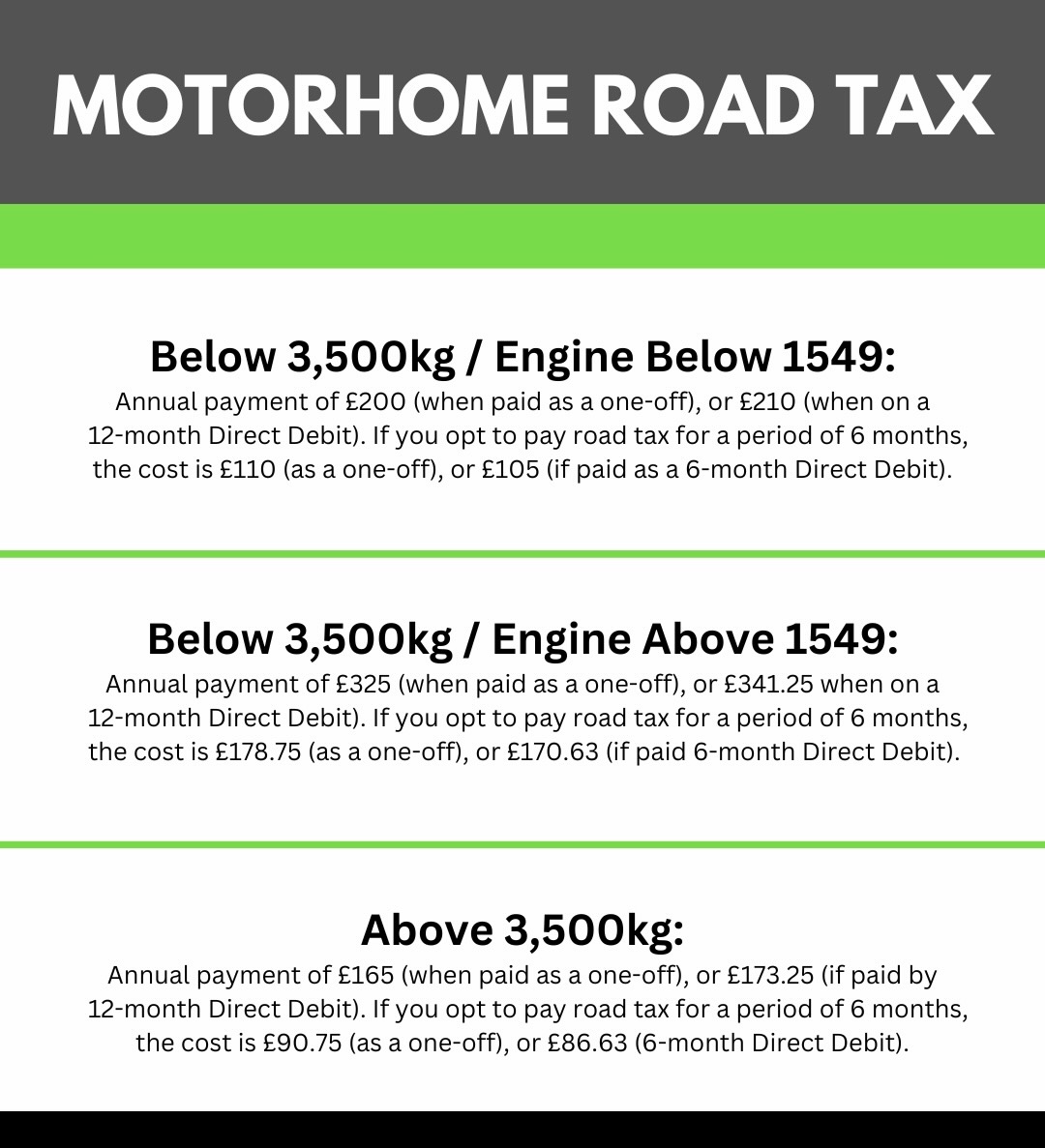

The current costs of road tax in the UK are detailed in this chart.

Road tax costs are subject to change, year on year, so when the time comes that you need to apply, it always makes sense to check the government’s website. There is a ‘tax checker’ there which offers a DVLA price check (plus other essential information on road tax and other related matters).

b) Age

If your motorhome happens to be more than 40 years old you won’t have to pay road tax. This is unlikely to be the case, but it is possible. The motorhome will be classed as a classic vehicle, i.e. vintage, and will therefore be exempt from road tax. You do still have an obligation, though, and must apply for historical road tax exemption. Also, according to the gov.uk website, motorhome tax rates change depending on the production date. For example, you'll pay a different price if your motorhome was manufactured between the April 1st 2017, and the March 11th 2020.

An essential part of vehicle ownership (of any kind) is making sure that you comply with the law and fulfil your obligations. This guide to motorhome road tax will help you establish the likely cost of the road tax for your motorhome, but don’t forget that you will have other legally obligatory things to pay for, too, including insurance.

If you’re thinking about buying a new or use motorhome, why not check out all of the latest deals we have on offer at Leisure World Group.